Agricultural Applications

The Global Anhydrite Market Industry benefits from its utilization in agriculture, particularly as a soil conditioner. Anhydrite Market improves soil structure and enhances nutrient availability, which is crucial for crop productivity. As global food demand rises, the agricultural sector increasingly adopts anhydrite to optimize yields. The incorporation of anhydrite in fertilizers is gaining traction, potentially leading to improved crop health and soil fertility. This trend aligns with the broader agricultural practices aimed at sustainable farming. The increasing awareness of soil health and productivity is likely to bolster the demand for anhydrite in the agricultural sector.

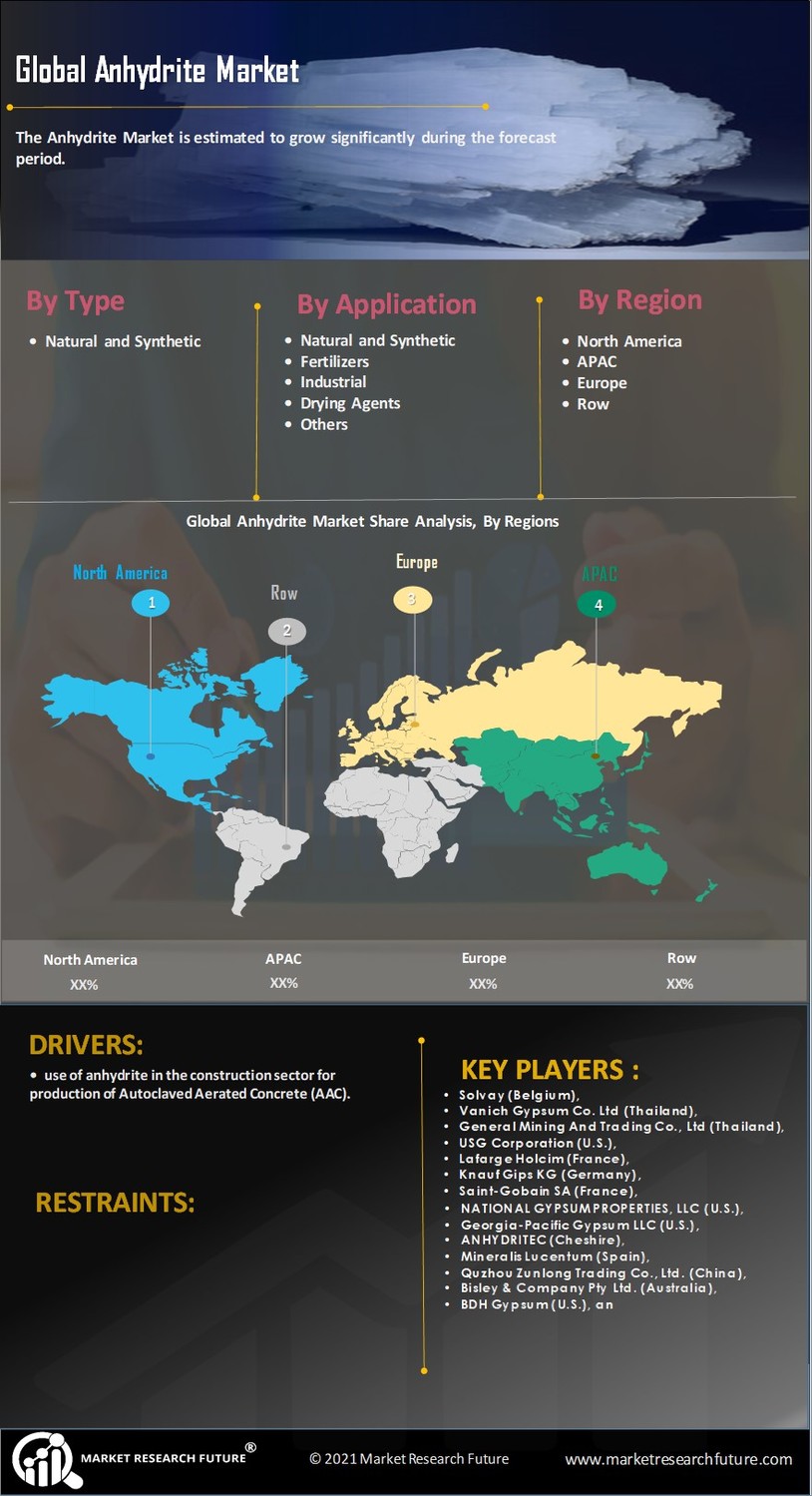

Rising Demand in Construction Sector

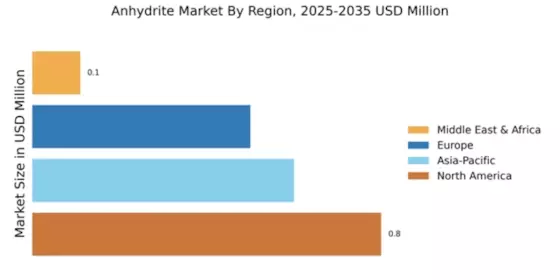

The Global Anhydrite Market Industry experiences a notable surge in demand driven by the construction sector. Anhydrite Market serves as a key component in the production of cement and gypsum-based products, which are essential for various construction applications. As urbanization accelerates globally, the need for infrastructure development increases, thereby propelling the consumption of anhydrite. In 2024, the market is projected to reach 0.24 billion USD, reflecting the growing reliance on anhydrite in construction materials. This trend is expected to continue, with the market anticipated to expand significantly as construction activities ramp up in emerging economies.

Technological Advancements in Mining

Technological innovations in mining processes significantly impact the Global Anhydrite Market Industry. Enhanced extraction techniques and processing technologies improve the efficiency and yield of anhydrite production. These advancements not only reduce operational costs but also minimize environmental impacts, making anhydrite more appealing to manufacturers. As companies adopt these technologies, the supply chain becomes more robust, ensuring a steady flow of anhydrite to meet rising global demand. The integration of automation and data analytics in mining operations is likely to further streamline production processes, contributing to market growth.

Growth in Global Population and Urbanization

The Global Anhydrite Market Industry is significantly impacted by the rapid growth of the global population and urbanization trends. As more people migrate to urban areas, the demand for housing and infrastructure escalates, leading to increased consumption of construction materials, including anhydrite. Projections indicate that by 2035, the market could expand to 4.02 billion USD, reflecting the correlation between urban development and anhydrite usage. This growth trajectory suggests a compound annual growth rate (CAGR) of 29.4% from 2025 to 2035, highlighting the critical role of anhydrite in meeting the needs of a burgeoning urban population.

Environmental Regulations Favoring Natural Minerals

The Global Anhydrite Market Industry is positively influenced by stringent environmental regulations that promote the use of natural minerals over synthetic alternatives. Anhydrite Market, being a naturally occurring mineral, aligns with the growing emphasis on sustainability and eco-friendly practices. Governments worldwide are increasingly implementing policies that encourage the use of natural resources in construction and agriculture. This shift not only supports the market for anhydrite but also positions it as a viable alternative to synthetic materials, which often have higher environmental footprints. The trend towards sustainability is expected to drive demand for anhydrite in various applications.